NSE is world’s number one exchange in terms of daily orders in Options trading. Options trading on the NSE has transformed the Indian capital markets, providing investors with innovative tools to manage risk and capitalize on market opportunities YES that is the actual meaning of “Options” rather than just Speculate.

A pivotal moment came in 2016 with the introduction of weekly options contracts, offering traders enhanced flexibility to capitalize on short-term market movements.

Later Regulatory reforms, technological advancements, and growing investor participation have propelled the growth of options trading in India, empowering investors with new avenues for navigating dynamic market conditions.

Soon after NSE Success BSE has also joined the party by launching Sensex & Bankex for weekly expiries, to sum up now we have each day is an “Expiry Day”

| Monday | Bankex- BSE & Midcap Nifty |

| Tuesday | Fin Nifty |

| Wednesday | Bank Nifty |

| Thursday | Nifty |

| Friday | Sensex |

But why this much Rush….?

Many individuals are drawn to options trading due to its potential for high returns and limited risk exposure. Options offer a unique opportunity to leverage market movements without the need for significant capital investment. This allure of potential profits has enticed individuals to explore the world of options trading.

But this is not an easy ride, Behind the scenes, professional traders employ disciplined strategies and risk management practices when navigating the options market. They leverage advanced analytical tools, conduct thorough research, and implement sophisticated trading techniques to capitalize on market opportunities. The practices followed by seasoned traders set them apart in this dynamic and competitive arena. For details you can read attached article. (https://finshots.in/archive/jane-street-millennium-management-hedge-fund-algorithm/)

According to a recent SEBI report, a staggering 90% of retail traders in options are losing money, with average losses amounting to approximately Rs.1.5 lakhs. This highlights the challenges faced by individual traders in the options market.

Initially, many retail traders were drawn to buying options due to the perceived limited risk. However, they encountered a low success rate with this strategy. On the other hand, selling options seemed appealing initially, offering potentially higher rewards. Some retail traders attempted to capitalize on this by writing far out-of-the-money options.

Additionally, a few brokers introduced “PRO accounts” that provided leverage to traders, albeit with interest costs. This allowed traders to amplify their positions and potentially enhance returns, albeit with added risk.

In this environment, retail traders are encouraged to carefully assess their options trading skills and strategies before diving in. While options trading can offer opportunities for profit, it’s essential to understand the risks and challenges involved to navigate the market effectively.

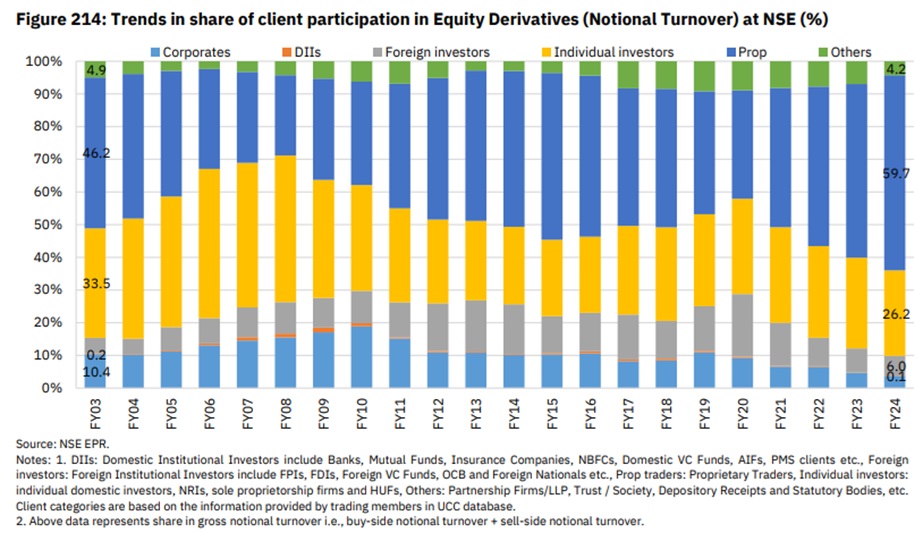

Below is the data published by NSE – Market Pulse suggest Proprietary volume share in NSE Derivative increased to 59.7% from 46.2%, While retail volume share has been declined to 26.2% in last 20 Years.

Source: NSE Market Pulse- April-24

Furthermore, most of the clients overtrading their account to make quick bucks. Discount brokerage account tempting them to trade more and tried their luck specially on expiry day- “Hero or Zero Trade”. Most of the traders lacking basic set up of risk management and position sizing.

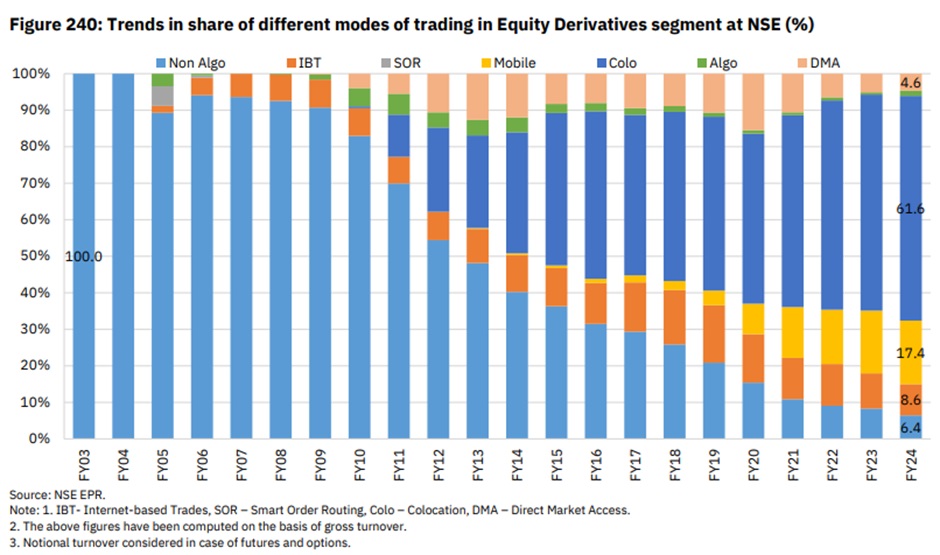

Institutions have more edge in executing their trades. Professoinal run their trade on “Colocation server” (Server placed at exchange facility itself) which offer them a fraction of early rate refreshment then traditional method. This allowed them to exit their position before other orders placed. Below is the data how the trade is being carried out on NSE. Presently 61.6% trades executed at NSE are based on Colocation orders. This type of order mechanism called Hi-frequency trading (HFT) which is majorly accessed by Institution.

Source: NSE Market Pulse- April-24

So, in nut shell Institution has better execution system, better knowledge, and most importantly huge capital with extra ordinary risk management system in place, they always having upper hand on retailer.

The Injection Effect:

Many time we see sharp move of 200/300 points in Indices on expiry day and that too in couple of Seconds, later Price comes to its previous level, this calls an “Injection effect” as short term candle 1-5 Min seems like an Injection so Market termed it as an “Injection Effect”. In which Index volatility makes large high and low on short time frame to sweeping of Stop Loss orders and kick out weaker hands from Market. Retail traders cannot handle such a volatility and result in to loss of money.

Below is the intraday 5 min chart of Banknifty where you can see it had made low of 47063 and immediately came back to its original trading range, later made high of 48164.

As a retail trader we must use options for their actual purpose that is hedging and Risk- defined strategies. In Current environment it is just matter of time to blow once capital without proper system.

Considering the so much retail fancy Regulator SEBI may tighten derivative norms. Recently RBI has stop trading in Currency segment to end Speculation. Regulator sooner or later comes in to action with full force. Till than enjoy the Option trading.

Want to learn more about Option Trading? Don’t forget to connect with Finix Capital for offline stock trading courses in Ahmedabad.